Proactively detect real risk with AI, generate customer risk-rating with ML, leverage unstructured data with NLP, make better decisions with actionable insights

Revolutionize information discovery to outsmart fraudsters & onboard customers wisely

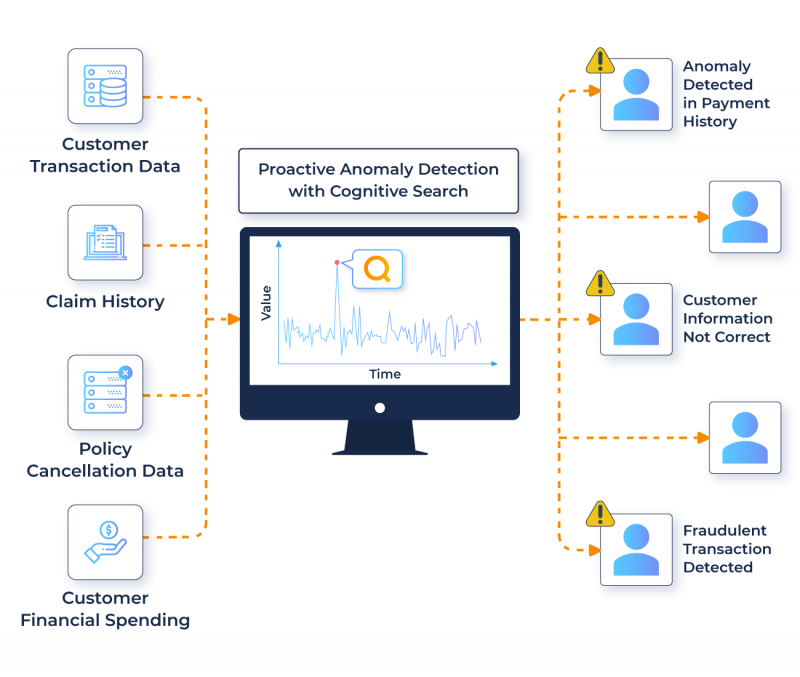

SearchUnify trains machine learning algorithms to sense normalcy of the continuous stream of incoming data, from opening a new account, banking transactions, and loan applications. Whenever the algorithm uncovers any payment anomaly, or fraudulent claims, it notifies the financial institution and they scrutinize the suspect’s profile to proactively detect fraud and manage risks.

SearchUnify indexes big data volumes, consisting of both structured and unstructured data to help financial investigators of banking and insurance evaluate the risk associated with a potential customer. Based on the risk assessment performed, financial institutions can onboard customers with low-risk profiles, thus, minimizing fraudulent activities.

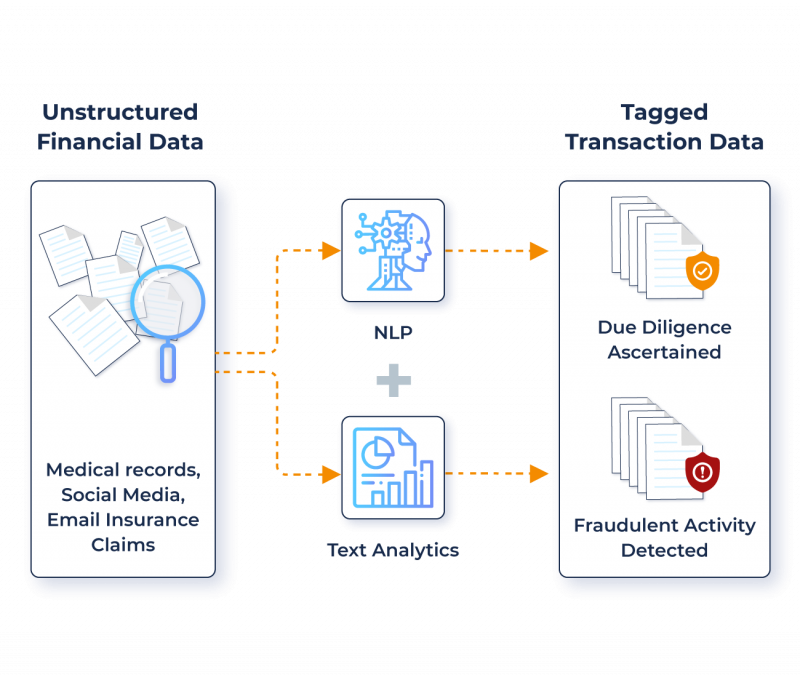

Financial institutions gather a trove of data in many different languages from an assortment of sources, including smartphone apps, insurance claims, email campaigns, medical health records, and so on. SearchUnify leverages NLP to organize, decipher, and analyze all the data and provides a competitive advantage to financial institutions and improves their revenue streams.

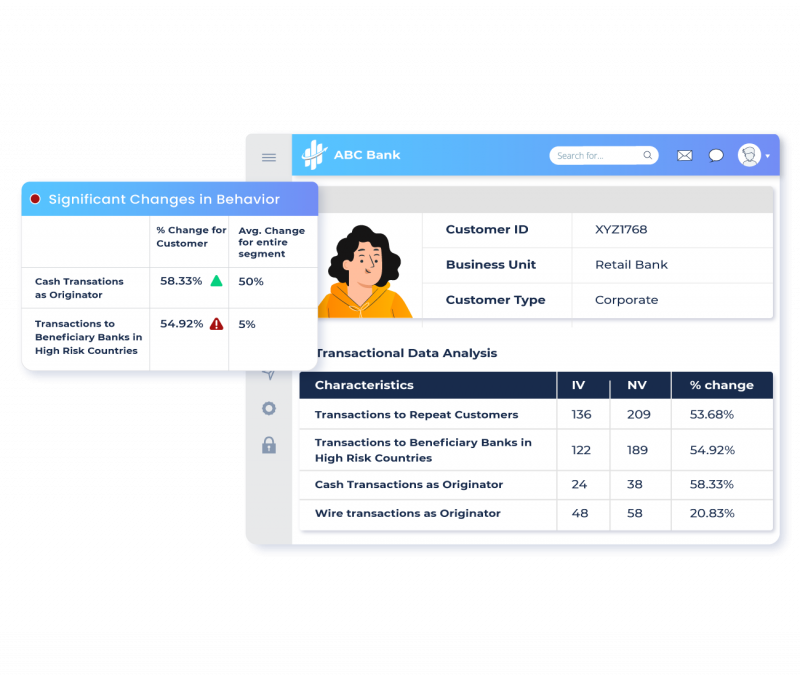

Driven by artificial intelligence and machine learning, SearchUnify analyzes financial transactions from the existing database and draws relationships between data and trends. It keeps an eye on every account by tracking the origins or transactions, therefore, visualizing potential threats and money laundering without any hassle.

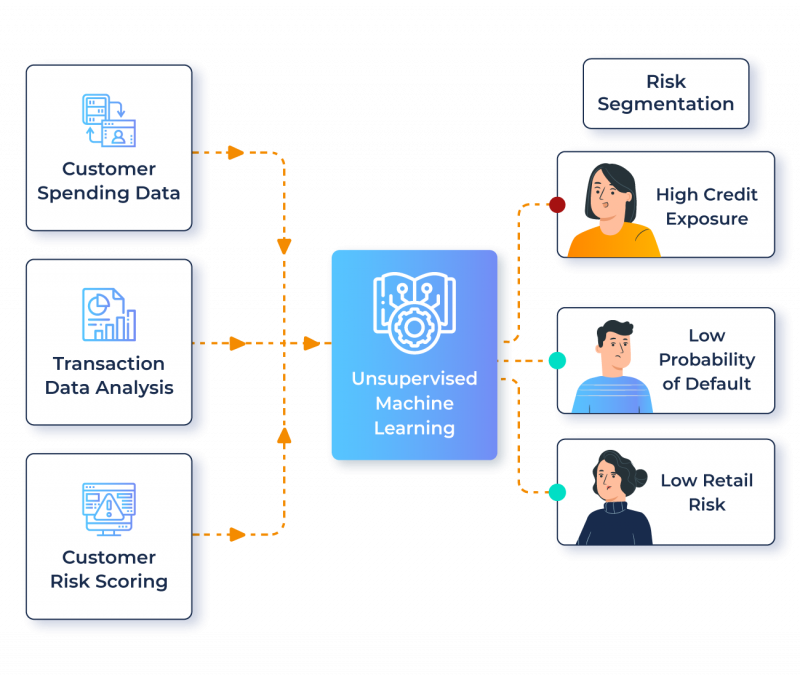

Wherever there’s negligible availability of tagged transaction data, unsupervised models are capable of tracking emerging fraud attacks that may successfully deceive any other form of analytics. With the unsupervised learnings of SearchUnify, financial institutions can identify anomalous behavior much faster, more accurately, and on a more scalable basis than human judgment alone.

Know the latest trends and best practices in customer support

View all ResourcesDon’t just believe everything we say. Not yet. Experience the power of unified cognitive technology and see how it helps you delight your customers, stakeholders, and employees. Take a live demo. It’s free!