Onboard customers efficiently, detect fraud, assess risk and enhance self-service adoption to improve customer loyalty

Transform data retrieval to improve employee efficiency and redefine customer experience excellence

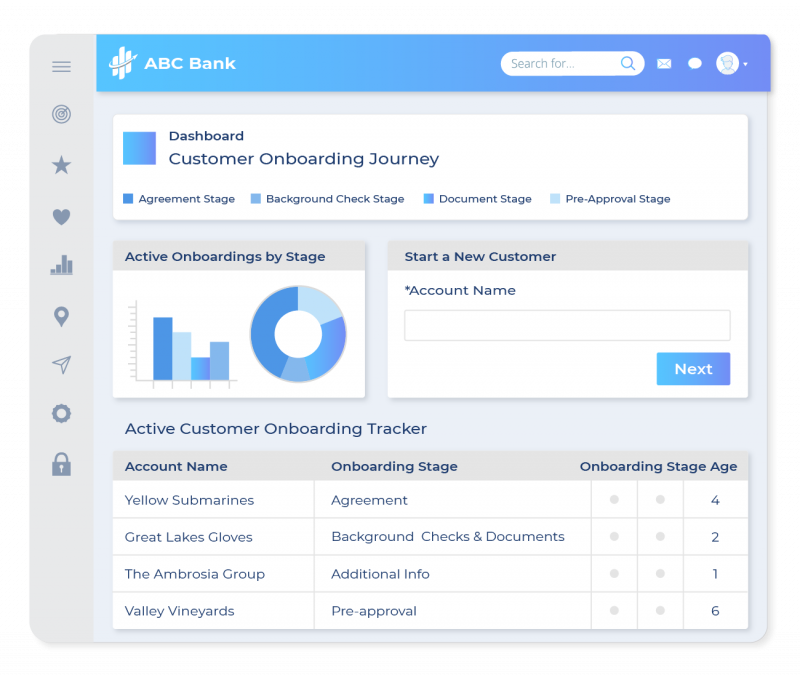

Create a seamless digital onboarding experience by unifying data from multiple, existing KYC/CDD/EDD solutions. Enable automated background checks and bid adieu to a cumbersome onboarding process. Learn everything you need to know about your customers with just a few clicks.

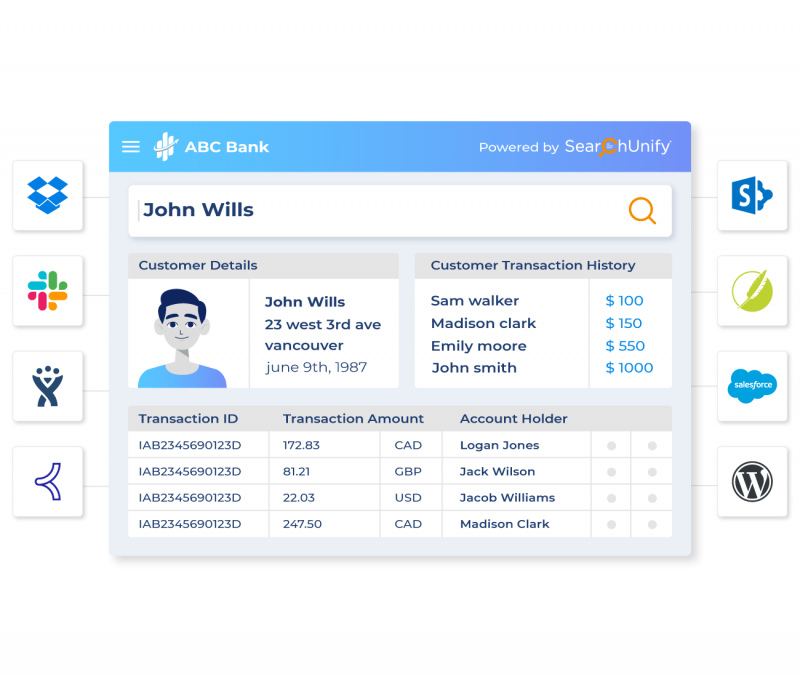

SearchUnify leverages ML & AI to retrieve relevant results from disparate data repositories. It gives bankers a 360-degree view of their clients by letting them access annual reports, risk analytics, industry blogs, social media, and many other data points. SearchUnify enables informed investment-decision-making, opportunity sourcing and deal origination.

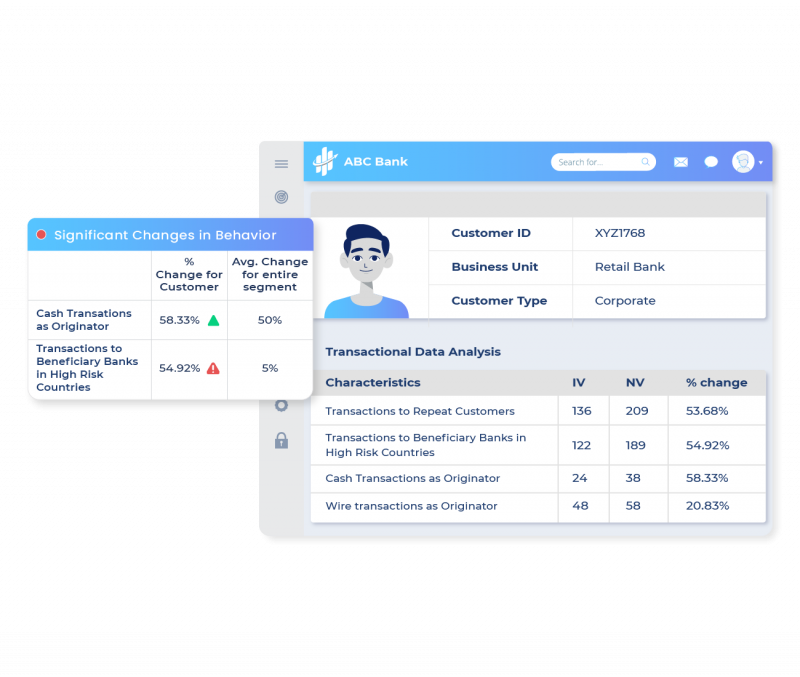

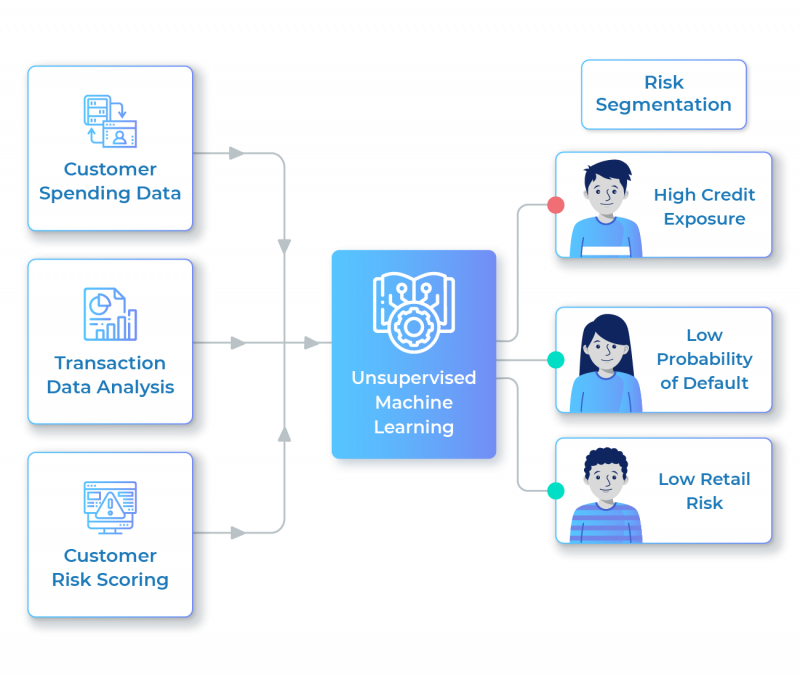

Banks have multiple transactional data and digital interaction points around customer profile, claims, customer payment history etc. SearchUnify exploits these massive data repositories to access authentic and reliable credit reports. You can proactively leverage these reports to anticipate frauds, while uncovering payment irregularities and other unusual activities.

SearchUnify’s approach unifies customer accounts and transactions for comprehensive crime analysis. By interacting with data, analyzing customer payment history and identifying bizarre patterns, SearchUnify ensures adherence to the Anti Money Laundering Act and other similar rules & regulations.

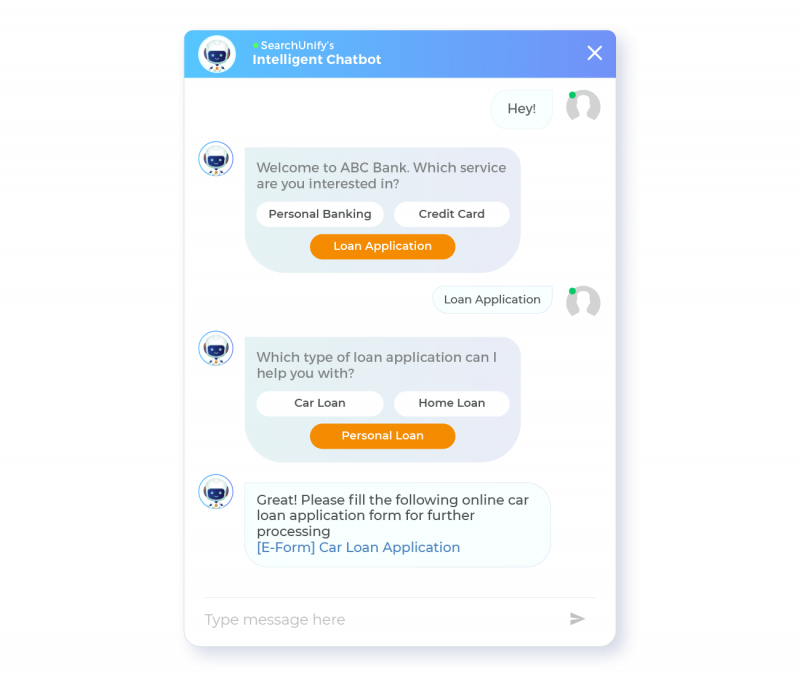

Leverage search-powered chatbots to find answers to customer queries from anywhere across the enterprise. Resolve L1 customer queries, like checking account balance, status of transaction requests etc., without the involvement of a support agent. The bot also acts as a 24X7 banking assistant by helping automate mundane tasks like blocking/unblocking a card, changing atm pin etc.

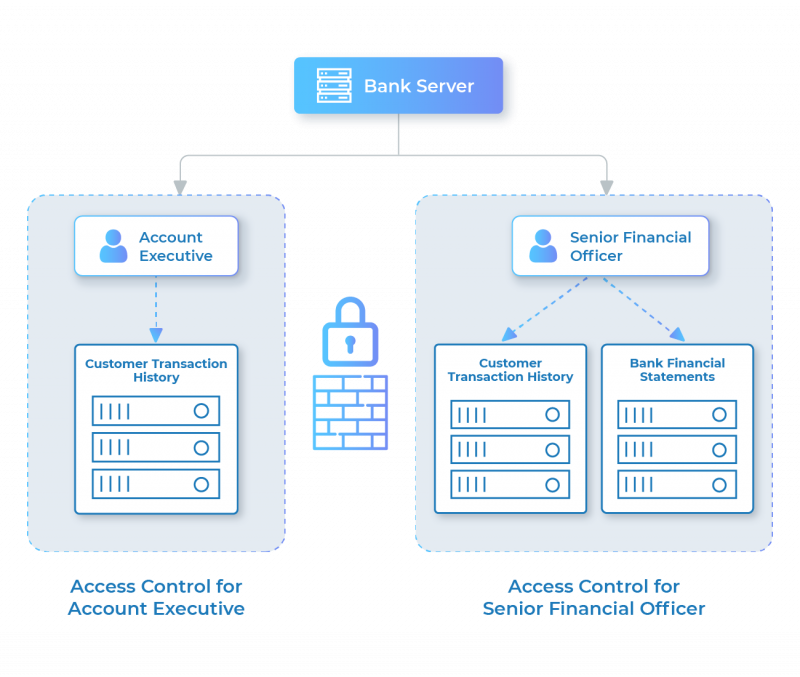

Encrypted with cutting-edge SSL technology, SearchUnify ensures industry-standard data confidentiality, integrity and availability.

Role-based access control defines a user’s level of accessibility, thus restricting access to sensitive banking data.

Know the latest trends and best practices in customer support

View all ResourcesDon’t just believe everything we say. Not yet. Experience the power of unified cognitive technology and see how it helps you delight your customers, stakeholders, and employees. Take a live demo. It’s free!